Protecting Your Hard-Earned Money in Uncertain Times - Part 1/4

The world is shifting into a new phase of madness. Countries are militarizing, people are looking for safe havens, and travel may soon become more challenging as countries become more insular.

This post relates to travel in that you may find your life difficult if you don't protect your hard-earned income and investments.

We all look for patterns to help us understand our environment. It's a human survival instinct. I've spent years studying history and economics, trying to understand the patterns that shape the world—how government policy decisions ripple through economies, how wealth is created and lost, and most importantly, how ordinary people can protect what they've worked so hard to build.

If history and experience have taught me one thing, it's that nothing is certain, and nothing lasts forever.

Just like everything in the universe, economies go through cycles. Countries go through booms and busts, power and ruin. Even when their intentions are good, governments sometimes get their policy impacts wrong. It's far worse when a government exhibits rotten intent.

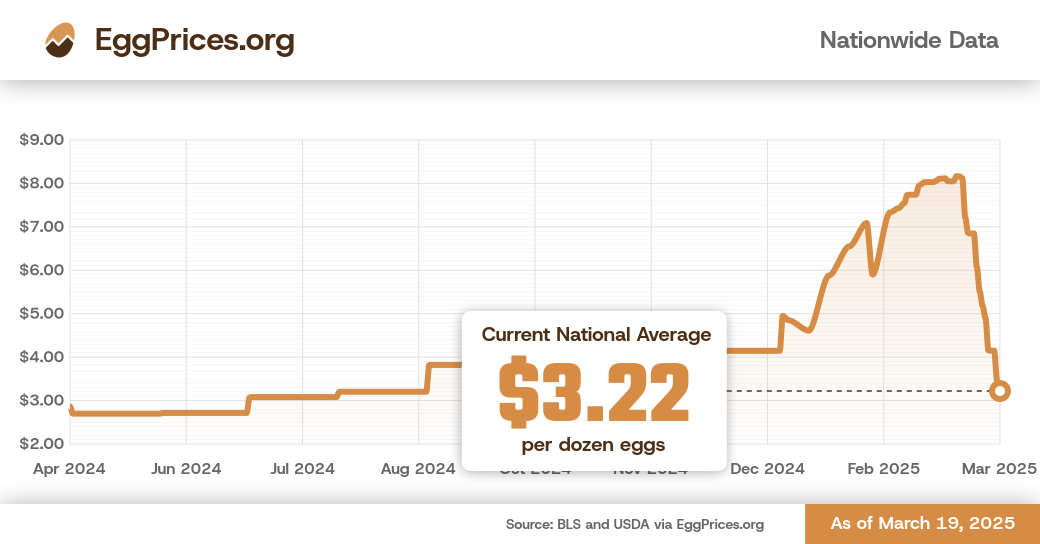

Inflation rises and corrodes the income and value of everything, diminishing your purchasing power. Simply put, people now pay $6.69 for a dozen not-really-large eggs in Kroger in Atlanta, which was $3.39 a year ago. While your income has not doubled, much of your basic food cost has. So, your purchasing power dropped about 50%. I learned very early in my adult life that nominal prices are inflexible downwards, meaning prices always go up and rarely down.

Jobs appear and disappear, giving you income one day and suddenly, the next day, dependent on savings. That is if you have savings. You may be keeping up with the frenetic news cycle, contributing to much degradation of your mental health. You notice that policies are changing rapidly and with a clear yet rarely admitted purpose. Policies that work for the middle class today might be gone tomorrow, replaced by systems that benefit the super-wealthy and leave the rest to fend for themselves.

Capitalism is an incredible system for creating productivity, trade, innovation, and output incentives. Unchecked and in the wrong hands, it is also a system that eventually eats itself, destroying consumers and the environment because the same profit incentive often blinds people to understanding where that profit comes from. The profit comes from a cyclical system of production and consumption.

If you can't consume as much because you have no job and, therefore, no money, why would a producer of goods, services, and IP survive? What's the point of innovation without sustainably liquid buyers? With so few consumers, is the business even viable? This seems logical to many who truly understand economics and are honest.

Super-wealthy people and corporations, captured policymakers, and governments forget these basic facts because they are incentivized to optimize benefits for themselves without thinking of the wider society. If you're in the middle class—earning a decent income but not sitting on generational wealth (like many of us without a trust fund)—you must be smart about protecting what's yours.

I know some friends and family prefer to stick their heads in the sand like an ostrich and hope and pray the world goes back to normal. That behavior never works. I've been thinking about how to maintain financial independence in a world that feels increasingly unstable.

I can't let anything get between my world travel and exploration. I want to share some strategies for different types of people—whether you own land, live in an apartment, invest in the stock market, or live paycheck to paycheck. Lastly, in Part 4 of this series, I want to talk about building communities. First, take your head out of the sand. No one is coming to save you, so you need a plan and need to implement it.

If You Own Land, Use It to Secure Your Future

"The idea of nurturing a lawn at the entrance to private residences and public buildings was born in the castles of French and English aristocrats in the late Middle Ages....Humans thereby identify lawns with political power, social status and economic wealth. ... At first only bankers, lawyers and industrialists could afford such luxuries at their private residences. Yet when the Industrial Revolution broadened the middle class and gave rise to the lawnmower and then the automatic sprinkler, millions of families could suddenly afford a home turf. In American suburbia a sick-and-span lawn switched from being a rich person's luxury into a middle class necessity." Yuval Noah Harari, Homo Deus,

If you have access to land—even a small backyard—you're already ahead of the game. Land is one of the best tools for survival and financial security. Check your Home Owners Association (HOA) bylaws and regulations to see what's possible. Some HOAs want to protect their home value and may see backyard garden farms as devaluing the subdivision. Find out how you could do it without causing a problem. It might be that you need a fence to hide the view. Perhaps you just need to avoid noisy or smelly animals. It could be that it has to be such that others can't see it.

As Yuval Noah Harari, the author of Homo Deus, pointed out, we aim to be like kings and queens with grass lawns and ornamental gardens instead of food on our lands. Remember that the royals had a peasant farmer class to produce food for them since the royals owned all the lands. If you get permission cleared away, or maybe you don't have an HOA (lucky you), then here is stuff you can do.

1. Start Growing Your Own Food

• Inflation makes groceries more expensive, but a backyard garden gives you control over your food supply or at least supplements some of your diet.

• Start with high-yield crops like potatoes, tomatoes, beans, and leafy greens—things that grow quickly and feed a family. Get everyone in your household, including anyone who likes food, to participate so they can build expertise and share in their food production.

• If you live in a warmer climate, plant fruit trees—mangoes, oranges, lemons, lime, apples, figs—something that keeps giving year after year.

• Herbs are easy to grow and expensive in stores—basil, rosemary, thyme, cilantro—grow them instead of buying. In all cases, start with what will grow naturally in your climate and avoid other things that won't.

2. You May Have Lots of Spare Land.

If you have lots of spare land and no close neighbors, you could explore raising small livestock, if possible. In some cases, you still have a job, so you could do this part-time or hire someone to help you part-time, or even contract someone else to run things and have an arrangement for you to get some of the produce, and they can sell the rest to cover their income.

• Everyone is complaining about the price of eggs these days. Monocultures have historically been the best means of infecting crops or animals, such that they create scarcity and cause price hikes. With bird flu infection in chickens and the need to cull them, and farmers seeing an opportunity to increase prices beyond what the shortage would have caused, prices have ballooned for more temporary profits.

If you have the option and space, chickens are one of the best investments—they give you eggs daily and don't require much space. Occasionally, you can kill one for meat to keep your population down. This was one way both my grandmothers lived when I was a kid. They had multiple sources of income, including a bakery and pastry shop, plant sales, and house rentals, yet still, they kept chickens. They had free eggs and an occasional homegrown, organic chicken for dinner.

• If you have a little more land, consider goats for milk or meat. Maybe you have access to free open and unused government land. One of my cousins in Antigua owns thousands of goats, which makes him a good living. They are like a bank account that he can cash in slowly. I inherited goats and sheep from my mother when she migrated to America, which helped me pay my school fees and expenses.

• I have never had rabbits, but I know they multiply…well…like rabbits, really fast, and are a great low-cost meat source if you eat meat. Just feed them from the small vegetable garden the stuff you won't eat.

3. You can also Use Your Land for Passive Income

• Rent out a small portion of your land for tent campers or RV travelers through platforms like Hipcamp or Airbnb. Better yet, set up your website and social media accounts and market it slightly cheaper than Hipcamp or Airbnb to drive traffic there. Just provide paid access to clean water, shower, toilets, wifi, and a small garden, and you have a space that can make passive income. A friend of mine just stayed at an Airbnb, which is a glamping tent. I stayed in a tree house once that was beautiful but easy to build. These are easy to set up, and if you don't want to or can't run them yourself, hire someone and share the income with them.

• If you want something a bit more permanent and that can withstand the storms, and you have some more money, build a tiny home or guesthouse to rent out for extra income. It could be long-term or short-term rent. If it's on wheels, you often don't need a license or would be breaking any non-short-term rental laws in your city. Check your laws first to make sure.

• Sell homegrown produce, eggs, or handmade goods at local markets. You can sell it online, to a store, or go to the market and sell it yourself. You can also exchange with other small farmers for stuff you don't have, a kind of food barter. My maternal grandmother and I did this with other small farmers when I was growing up. I have a friend in the French countryside, and she does the same. Coming home to a box filled with fresh fruits and vegetables at your front door is always a wonderful surprise! 😃

Build a Community You Can Count on

I will elaborate more on this in Part 4 of this financial protection series, but I will just say here that part of protecting your hard-earned money is to build a community at home and in your neighborhood of real people, not social media "friends," to ensure you have help when you most need it. Read the full series to learn how to build community and why you need to.

Final words on This Topic

Owning land is about using that land to generate value. Don't just let it sit there. Let it work for you. This is true even if you are paying rent. I have a friend who has some extra land in the back of her apartment that could be used for a food garden. Even if she just threw some seeds without tending the land, within a short time, she would have something she could eat from it. Plus, connection to what you consume, actually participating in nourishing something that in turn nourishes you, is one of the best feelings in life.

Not everyone owns land, so in addition to Part 4 on community building, I have written more options for people who live in apartments and those who live paycheck-to-paycheck in Parts 2 and 4 of this post. Come back next week for more to learn how to invest in stocks during uncertain times.

Come back next week for the section: "If you live in an Apartment, how do you invest wisely and diversify your income?"

You can read them for free, but you must sign up to read the remaining Parts.

Sign up for free below and have it delivered to your inbox so you don't miss it.

Caveat & Disclaimer

The information provided in this article is for informational and educational purposes only and should not be considered financial, investment, or legal advice. While I share insights based on economic principles and investment strategies, all financial decisions should be made based on your personal circumstances, financial goals, and risk tolerance.

I strongly encourage you to consult with a certified financial advisor, tax professional, or investment expert before making any financial decisions. Investing in the stock market involves risks, including the potential loss of capital. Past performance is not indicative of future results, and no investment is guaranteed to generate returns.

Neither I nor my company assumes any responsibility for financial losses, investment decisions, or economic outcomes based on the information presented in this article. You are solely responsible for your financial choices, and it is essential to conduct your own research and seek professional guidance before acting on any financial or investment recommendations.

Member discussion